Present Value: 0 $

Understanding the Discounted Cash Flow Calculator

Navigating the financial waters can sometimes feel like you’re lost at sea. Terms fly around, numbers swirl, and before you know it, you’re left scratching your head. Don’t fret – I’ve been there, and so have many others. That’s why we’re here to chat about the Discounted Cash Flow (DCF) Calculator. Think of it as your trusty compass in the vast ocean of finance. Let’s break it down, shall we?

So, What’s the DCF Calculator All About?

Picture this: you’ve got some money, and you’re thinking about investing it. But how do you decide if it’s worth it? Enter the DCF Calculator. In simple words, it helps you understand how much future money is worth today. This makes sense, right? A dollar today won’t be worth the same five years from now.

Let’s Get Into the Nitty-Gritty:

Let’s Get Into the Nitty-Gritty:

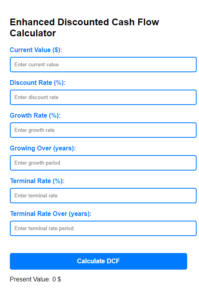

- Current Value: This is the starting point – how much money are you looking at right now?

- Discount Rate: Think of this as your “what’s it worth” rate. If you could invest elsewhere and get a 7% return, then that’s your rate.

- Growth Rate: How much do you think your money will grow each year?

- Growing Over: How many years are we talking about here?

- Terminal Rate: This one’s a bit tricky. It’s like asking, “What if my money keeps growing, but at a slower pace?”

- Terminal Rate Over: And for how many years will it grow at this slower pace?

Alright, But How Do I Use It?

Honestly, it’s simpler than assembling that DIY shelf you bought online.

Let’s Walk Through It:

- Kick-off with Current Value: Jot down your starting amount.

- Pick Your Discount Rate: Remember the “what’s it worth” rate? Use that.

- Guess Your Growth: This is where you daydream a bit. How much do you see your money growing every year?

- Duration Matters: How many years are you dreaming for? Jot that down.

- The Slow Grow: If you think the growth slows down after a point, this is where you guess by how much.

- And for How Long?: How many years will it take this slower pace?

Done guessing? Click on ‘Calculate’. And voilà! You’ll see a number which is essentially your future money’s value today.

Why Should I Care About the DCF Calculator?

Well, it’s like having a financial crystal ball:

- Smart Choices: Ever felt the sting of a bad investment? This tool is your safety net.

- Business Buff: If you run a business, it gives you a clearer picture of what your company could be worth based on future earnings.

- Plan Ahead: Think of it as your financial GPS. Know where you’re heading.

Quick Tips for a Clearer Financial Picture:

- Do Your Homework: The better your guesses, the clearer your picture.

- Stay Updated: Keep an eye on the market. If things change, adjust your numbers.

- Double-Check: Pair the DCF with other methods for a well-rounded view.

Wrapping Up

Life’s a journey, and so is finance. Tools like the Discounted Cash Flow Calculator are like signposts along the way, helping ensure we don’t stray too far off the path. So next time you’re pondering an investment or just curious about the value of money down the line, you know where to turn.

Best Paypal fee calculator-toolnestseo

FAQ – Answering the Burning Questions

Q1: Is the DCF Calculator foolproof?

- No tool is. It’s super helpful but only as accurate as the info you feed it.

Q2: When should I revisit my DCF calculations?

- Whenever there’s a major market twist or you get fresh financial insights.

Q3: Is the DCF method good for all investment types?

- It’s best for more predictable investments. For wild, speculative ones? Maybe not your first go-to.

Hope this clears the waters a bit. Here’s to smart, informed financial choices! Cheers!

discounted cash flow calculator

dcf formula

dcf calculator

discounted cash flow formula